Insurance which is provided to protect against loss by bodily injury or by health is health insurance. Health insurance usually provides coverage for medicine, visits to the doctor or medical facilities, hospital stays, and other medical expenses. Various plans are available, and there is balancing to be done in order to make premiums go up or down, the limits of coverage and the and these include raising the amount of coverage, the size of the deductible, or the co-payment while lowering the amount of monthly or quarterly premiums the insured is charged.

Categories

Comparative ShoppingFraud |

Feature Article

ObamaCare: Love It Or Hate It

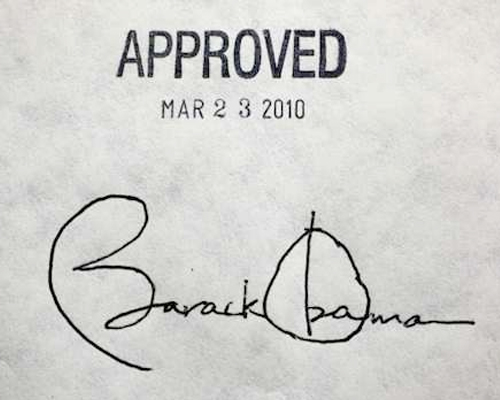

The Patient Protection and Affordable Care Act is also commonly known as

ObamaCare. The Affordable Care Act was signed into law by President Obama on

March 23, 2010 and later upheld by the Supreme

Court on June 28, 2012.

This law is one that most people either love or hate; the votes in both the

Senate and the House of Representatives were almost entirely on party

lines.

Those who love it point out these facts:

ObamaCare:

- allows adult children to stay on their parents' health insurance until they reach the age of 26;

- stops insurance companies from dropping insured people because of pre-existing conditions;

- subsidizes health insurance costs;

- mandates that most people buy healthcare insurance which complies with the federal government's "credible coverage;"

- gives all preventative and wellness services free of charge to those insured; and

- all insurance policies must have prescription drugs, emergency care, maternity, and neonatal care in order to be considered credible coverage; and

- everyone receives such benefits as perinatal, pediatric services, mental health and substance abuse services.

Amazingly, those who hate it point out the same facts!

They assert that the United States Constitution does not give the federal

government the power to mandate that Americans buy any product that they

don't want or feel they need, and they decry the new taxes

that the mandates carry with them.

While individuals are mandated to have coverage by 2014, a special exemption

was put into place last year which allows employers an extra year before

they have to offer it. Critics say that places an undue burden on the middle

class and the working

poor, many of whom are now left to find health plans on their own,

because they are required to obtain credible insurance coverage by 2014 or

get a waiver, or they will pay a "per-month" fee to the federal government.

The Affordable Care Act requires insurance companies which participate in

the marketplace to offer four new categories of insurance to consumers.

Those categories, from the lowest to the highest premiums, are called

Bronze, Silver, Gold, and Platinum Plans.

The Bronze Plan, which is described as having "essential health benefits,"

has the lowest premiums of these plans, but charge the highest out-of-pocket

costs. Those who opt for the Bronze Plan will pay 40% of their medical

bills, which is currently abnormally high co-insurance.

But more importantly -- and less understood by many who will be buying this

plan -- the average annual deductible is $5,081 for an individual and

$10,386 for a family.

What this means is that until the individual insured person pays $5,081 of

his own medical expenses, the insurance does not kick in. Those

out-of-pocket payments do not include premiums.

The average reasonably healthy person does not rack up that much in medical

bills in any one year, so many, if not most, people who buy the Bronze Plan

will be paying 100% of their own bills for their doctor's

visits.

Once these facts are realized by people, one would assume many would want to

leave the Plan, but that cannot be done mid-year; it can only be done during

the annual open enrollment period unless special circumstances are met, such

as moving

to an area where the existing plan does not have a network of providers.

On the other extreme, the highest premium plan is the Platinum Plan, which

has a $347 deductible for individuals and a $698 deductible for a family.

The average cost of a doctor

visit for Platinum Plan members is $16.00, and the insured is responsible

for only about 10% of the costs of their healthcare services.

Insurers are not mandated to offer the Platinum Plan, and it is believed

that most will not, as industry

analysts believe that this plan will attract people who are in ill health,

which would cost insurance companies large amounts of money, and since it is

now illegal to turn people down for insurance based on pre-existing

conditions, this could be financially disastrous for them.

The federal law requires all insurers who participate in the health

insurance exchanges to offer the two plans in between, the Silver and Gold

Plans.

The Silver Plan has an average individual deductible of $2,907 and family

deductible of $6,078, and the average primary care provider visit has a

copay of $32 per visit. The insured will pay 30% of the costs once the

deductible is met.

Those who choose the Gold Plan will pay 20% of covered healthcare expenses

after the deductible is met. The average deductible for this plan is $1,277

for individuals and $2,846 for a family; the average office visit with the doctor

is $24.

In the end, the success or failure of ObamaCare and the state health

insurance exchanges will not be known for a while, and in the meantime,

those that love the idea will continue to find its good points, while those

who do not will speak out against the bad points.

One thing is for sure: The unfolding will continue to be interesting to

watch.

Recommended Resources

Medical insurance quotes, personal advice, and general information for Connecticut residents by a local Connecticut father and son agency.

http://1800insurancect.com/

Website offers health insurance news and quotes from the top health insurance providers.

http://www.healthinsurancequotes.org/

Health Insurance Quotes Online

Website offers free health insurance quotes online by typing in one's zip code and then one is presented with quotes. Website also offers basic information about health insurance coverage.

http://www.healthinsurancequotesonline.org

HealthEquity and WageWorks have joined together to serve its combined employer clients through its Health Savings Account (HSA), Flexible Spending Account (FSA), Health Reimbursement Arrangement (HRA), COBRA, direct bill, commuter, fitness, and education reimbursement programs. An overview of the company, its clients, and consumer-directed benefits is set forth, and its leadership is introduced. Its products for individuals and businesses are featured, and contacts are provided.

https://www.wageworks.com/

We're here to help Kiwis and their families live healthier, happier lives, and to help local businesses who want to protect their employees. We do this by offering insurance that's easy to use and affordable while also helping connect our members to the right tools and services to improve their health and wellbeing.

https://www.nib.co.nz/

Save On Quotes - Health Insurance

Website offers information about and quotes for life insurance, as well as offering tips to obtain lowers health insurance rates.

http://www.saveonquotes.com/health-insurance/

Specialist life insurance broker in UK. Our team of expert advisers specialise in getting people with pre existing medical conditions life insurance or people who work in hazardous occupations or take part in extreme sports.

https://www.the-insurance-surgery.co.uk/